Uncover the Dutch 30% Ruling

Many know that 30% can help an expat save a lot of money. However, there are a lot of myths about the 30% ruling. In this article, we are going to uncover the 30% ruling, revealing all the secrets of the 30% ruling.

Ratio decidendi of the 30% ruling

The 30% ruling is created under the context of the Dutch Wage Tax Act 1964. The rationale of this tax facility is to reimburse certain expats for the occurred extraterritorial expenses (e.g. moving costs, travel costs, accommodation costs etc.) when they moved to the Netherlands. As an incentive to attract qualified expats from all over the world, 30% of their gross salary can be exempted from taxation for a maximum period of five years. As the main reason is to compensate the extraterritorial costs, there are no restrictions on the nationality of the applicant. Nevertheless, a (returning) Dutch citizen must meet much stricter conditions in order to qualify for 30%.

Significant benefits

Alongside the reduction of their taxable salary income, a 30% ruling grantee will also gain other fiscal advantages. The advantages of the 30% ruling can be understood when considering how personal income is taxed by the Dutch Tax Authority. In the Netherlands, various types of personal income are referred to as “boxes” and are grouped into three main categories. Taxable incomes from substantial interests in a company (“shareholding”) belong to Box 2. Taxable incomes from savings and investments fall under Box 3. After obtaining the 30% ruling, with regard to Box 2 and Box 3 types of incomes, an expat will be considered as a “non-resident taxpayer”. This means that incomes generated from substantial shareholding in a foreign company and from overseas investment portfolios (such as, real estate in the US) can be exempted from Dutch personal income taxation. However, if Box 2 and Box 3 incomes are generated in the Netherlands, they are still taxable. In other words, an expat is still obliged to report his Dutch possessions and his substantial shareholding in a Dutch company to the Dutch Tax Authority. The effect of the 30% ruling on Box 2 and Box 3 incomes can be quite significant. For example, an expat owns a couple of houses in the US and has a net worth of 4 million US dollars. Without the 30% ruling, the Dutch Tax Authority will presume that this US expat is capable of generating an approximate 4.7% return on the net worth, and that this 4.7% return shall be taxed at 31% per annum. This means that, without 30% ruling, this US expat will need to pay a wealth tax of about 59000 dollars per year to the Dutch Tax Authority. You can use this website to calculate how much wealth tax you will need to pay, if you do not obtain the 30% ruling.

Driver license

Some laws can be illogical. 30% ruling has its illogical trait. The Dutch Government presume that people who have higher income and 30% ruling can also drive safer and more responsibly. Therefore, people who obtain the 30% ruling facility can convert their foreign driver licenses into a Dutch driver license.

Eligibility requirements

To qualify for 30% ruling, an expat needs to meet certain conditions:

- Recruitment must have taken place outside the Dutch territory

To apply for the 30% tax facility, you must, during the period of 24 months prior to your first work day in the Netherlands, have lived at least 16 months or longer in a place which is outside the Netherlands and which is at least 150 kilometers away from the nearest Dutch border. Therefore, if you are residing in Belgium, Luxemburg, certain areas in Germany or the United Kingdom, you may not be eligible for the 30% tax facility.

An exception to this domicile requirement can be made if you obtain a PhD degree in the Netherlands. In this case, the Tax Department will look at the period preceding the moment that you started the PhD study in the Netherlands. For example, if you came to the Netherlands to follow a PhD study in September 2018, you are about to graduate in 2022 and apply for 30% ruling, then the Tax Department will examine the issue as to whether you could have fulfilled the domicile requirement in September 2018.

- Salary threshold

Not all expats are entitled to the tax facility. According to Dutch tax law, applicants with an annual taxable salary higher than EUR 39.467 are eligible. However, if you are younger than 30 and have a Master’s degree or higher, then a reduced salary threshold of EUR 30.001 applies. Moreover, for scientific researchers and doctors in training, there is no minimum salary required. Please check with your employer to verify whether you fall under the scope. (Figures above are valid until 31 December 2022)

Types of employment to qualify for 30% tax facility

As an employee

By meeting the salary threshold and fulfilling the domicile requirement, you are entitled to the 30% ruling after you have registered within the BRP system of a Dutch municipality. The reason why one must register his address with the municipality is that the purpose of this tax facility is to cover the extraterritorial costs of an expat. If an expat employee works remotely in his home country without moving to the Netherlands, then the Dutch Tax Authority cannot grant such a facility. Although the 30% ruling always ties to an employer, changing jobs is still possible without jeopardizing one’s entitlement to the tax benefit. In this case, the new employer simply needs to submit a new application within four months from the starting date of the new employment, given that you start the new job within three months after the termination of the previous job, and you still meet the other requirements under the 30% facility policy for the new job. Please be aware that, if you cannot find a new job within three months, your entitlement to the 30% ruling will lapse.

Self-employed

According to case law, as a self-employed expat in the Netherlands, you may be eligible for 30% ruling as well. You are required to set up a limited liability company (such as, 'besloten vennootschap' or BV) in the Netherlands and you are the shareholder of the business. Having it said, your company has its own legal entity, namely the status of legal personality. The company, as a legal entity, can hire you, as a natural person, to work as a managing director in the company. Hence, you will be given a job contract by your own company and you will get paid by your own company. If your salary exceeds the threshold and you meet the other conditions, you can be eligible for the 30% tax facility. The whole process from incorporating the company to concluding the employment agreement should be done outside the Dutch territory. It is common practice for Americans and Japanese who want apply for the Dutch self-employment visa under the Dutch-American Friendship Treaty or the Dutch-Japanese Trade and Maritime Treaty. For details, please read this article: Dutch American Friendship Treaty: a residence permit for American entrepreneurs

Policy development and puzzled case law

Can Dutch nationals enjoy the tax facility too?

Yes, but under a stricter domicile requirement. If a (returning) Dutch citizen wants to apply for 30% ruling, he/she needs to have lived 25 years or longer outside the Netherlands.

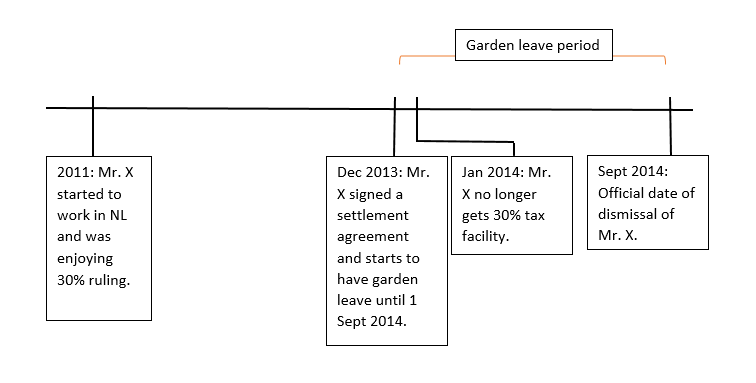

Can I get 30% tax facility during my garden leave?

According to a judgment given by the District Court of Zeeland-West-Brabant, the period (during which an expat gets suspended for garden leave) is regarded as ‘temporary inactivity’ as referred to in the Dutch Income Tax Act. In conjunction with the reading of the Dutch Wage Tax Implementing Decree, the duration of the evidentiary scheme (of 30% ruling) shall end on the last day of the wage period in which the employment had ended. In the preceding case, Mr. X came to work in the Netherlands in 2011 and he was consequently granted 30% ruling by the Dutch Tax Authority. However, in 2013, he concluded a settlement agreement with his employer with the purpose of terminating his employment relationship prematurely. In accordance with the settlement agreement, he would be exempted from work as from 1 December 2013. However, his contract would officially terminate on 1 September 2014. As from 1 January 2014, the employer stopped applying the 30% ruling to his salary, and Mr. X started a litigation procedure.

According to the judgment, a taxpayer who wishes to make use of the 30% ruling must perform actual work. With regard to Mr. X, since he did not engage in all any business activities as from 1 December 2013, the 30% ruling should end on 31 December 2013. In light of this case, expats who consider signing a settlement agreement and agreeing on a long ‘garden leave’ should be aware of the wording of their settlement agreement and the potential risks of losing their 30% ruling entitlement.

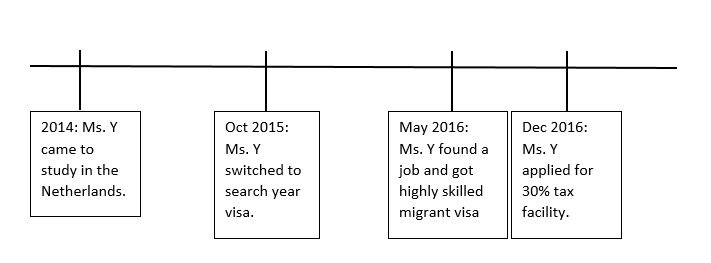

Can former international students and search year visa holders enjoy 30% ruling?

A groundbreaking judgment about whether former international students and search year visa holders can enjoy 30% ruling was made in 2019. This case concerns a Jordanian citizen, Ms. Y, who came to the Netherlands to study in 2014. Ms. Y completed her study and converted her purpose of stay to search year visa in October 2015. Ms. Y found a job and received her highly skilled migrant visa in May 2016. She applied for the 30% ruling, but her application was declined. After several administrative review and appeal procedures, the Appellate Court of Amsterdam (Gerechtshof Amsterdam) vacated and reversed the District Court’s judgment and ruled in favor of Ms. Y.

The judgment focuses on the personal nature and relationship between Ms. Y and the countries concerned. According to Ms. Y, she has held a driver license and a bank account in Jordan. Also, she has a separate dwelling inside her parents’ house in Jordan. During the period from October 2013 to February 2015, Ms. Y also worked as a freelance graphic designer for a Jordanian company (working remotely in the Netherlands). The court underlines the importance of the possibility of building a lasting bond between Ms. Y and the Netherlands. The Appellate Court found that ,although Ms. Y had been living in the Netherlands for some years before becoming a highly skilled migrant, first as a student then as a search year visa holder, it is not sufficient to build a lasting bond between Ms. Y and the Netherlands. The court reiterates that both the student and search year visas offered a limited ‘leave to remain’ in the Netherlands; From a relatively short-term right of residence in the Netherlands can be assumed that such residence permits will not be extended. Therefore, Ms. Y was not allowed to stay legally in the Netherlands for a longer period of time unless she could find a job here. The Appellate Court also points out that there should not be any special significance attached to certain circumstances, such as a person’s social or economic connection with a country in question. Despite the fact that Ms. Y has accommodation in the Netherlands, the mere residence in the Netherlands for following a study program and looking for a job does not entail a lasting bond. As a result, Ms. Y is entitled to the 30% ruling as from January 2017.

Although this is an enlightening case for lots of international students and search year visa holders, the Dutch Tax Authority follow a very narrow interpretation of this case and the Tax Authority conduct the individual assessments very stringently.

Contact us

Do you have questions about the 30% tax ruling, or do you want to confirm your eligibility for this tax program? You are welcome to contact Mynta Law.

Related articles

- Reasons why you should swap your highly skilled migrant visa for a Blue Card

- Unemployment benefit and its impact on your Dutch residence rights

- How can an American entrepreneur obtain Dutch permanent residence?

- Possibly longer search period for some (settled) highly skilled migrants

- Introducing the Entry/Exit System: Are you ready for the EES?

- Dutch American Friendship Treaty: how to renew your entrepreneur permit successfully

- Highly skilled migrant and sick leave

- Brexit permanent residence despite deregistration from the BRP system